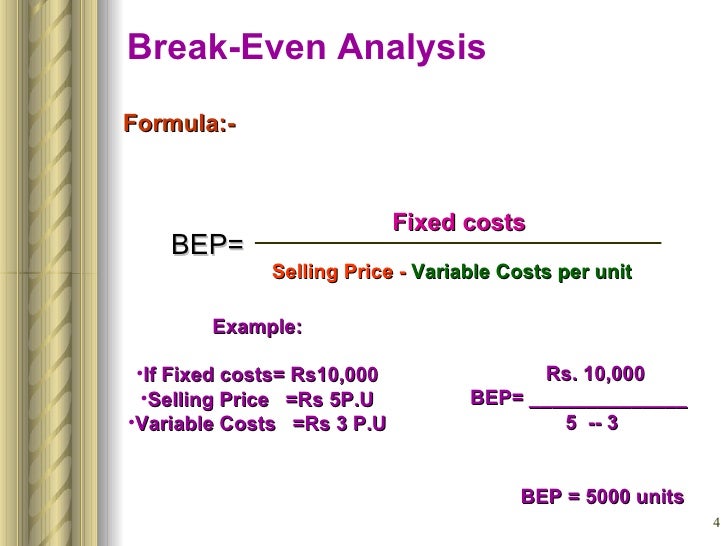

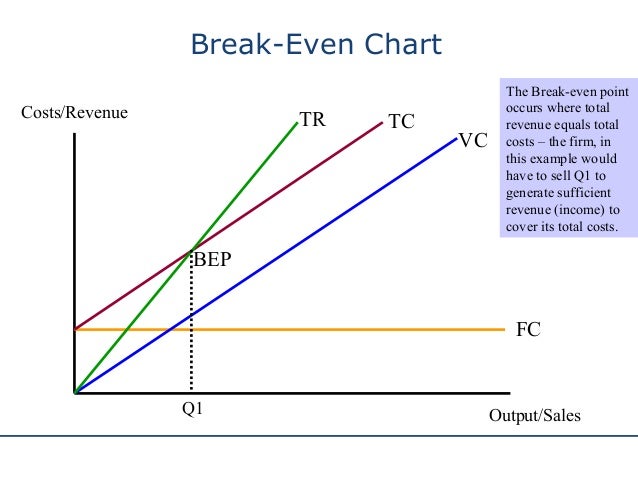

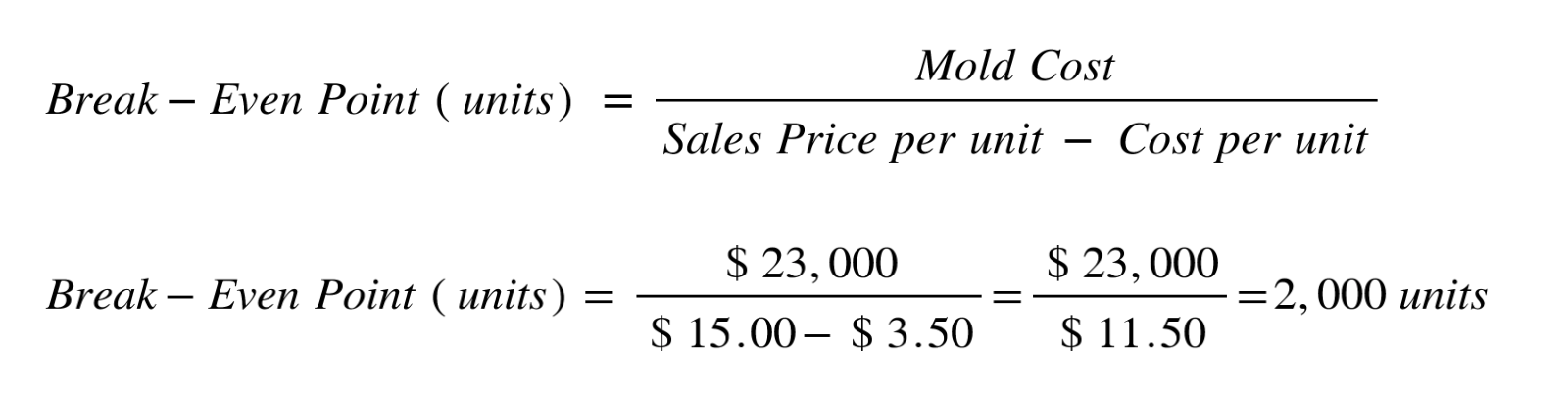

Mostly, low fixed costs will have a low break-even point of sale.įixed Costs: These are also known as overhead costs or expenses which remain the same and do not change with the varying output such as loan payments, rent, insurance or taxes. The total cost here comprises fixed and variable costs. This BEP analysis helps in determining the number of units or revenue needed to cover the total costs. For instance, in the world of finance and economics, the break-even point refers to the stage where total cost and total revenue becomes equal.

Finance break even point formula how to#

Revenue = Total Variable Cost + Total Fixed Cost How to Calculate the Break-Even Point? Business Break-Even Point Calculationīreak-even calculation is applied to a huge variety of contexts. BEP simply shows that all the costs have been covered, which means: Upon reaching the break-even point means, a business is not either making a profit or loss and thus it is referred as the no-profit or no-loss point. The BEP analysis is considered as a crucial and important financial tool which helps an entity to determine the stage at which the company or any new product will be termed as profitable. What is Break-Even Point?īreak-even point is used in multiple ways in the field of business, finance and investing. So, what exactly does the break-even point mean and at what stage one achieves this? Here’s a detailed guide on the meaning of break-even point and how to determine and calculate it. revenue per each fiscal year excluding donations from sponsors or advertisers.In this era of start-ups and unicorns, every smart business person would want to know when their business is going to be profitable or when will they reach a break-even point (BEP)? There are other queries in mind as well such as: Is it better to change the pricing structure to fetch profits or how to gain more profits than just recurring losses? It is the break-even point analysis which helps to figure out the answers of these above-mentioned questions. Its purpose is to prohibit clubs from spending more money on transfers than they earn as businesses, i.e.

It is known as UEFA Financial Fair Play Regulations. In soccer, the break-even requirement was adopted by UEFA. In medicine, it is a postulated state when the advances of medicine permit every year an increase of one year or more of the life expectancy of the living, therefore leading to medical immortality, barring accidental death.

Finance break even point formula code#

In computer science, the term (used infrequently) refers to a point in the life cycle of a programming language where the language can be used to code its own compiler or interpreter. In energy, the break-even point is the point where usable energy gotten from a process equals the input energy. The notion can also be found in more general phenomena, such as percolation. In nuclear fusion research, the term break-even refers to a fusion energy gain factor equal to unity this is also known as the Lawson criterion. This method not only accounts for all costs, it also includes the opportunity costs of the capital required to develop a project.

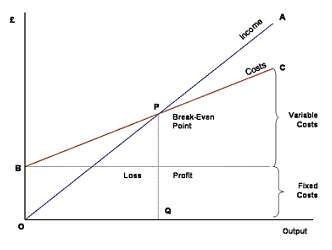

The financial method of calculating break-even, called value added break-even analysis, is used to assess the feasibility of a project. The accounting method of calculating break-even point does not include cost of working capital. Establishing the break-even point helps businesses in setting plans for the levels of production it needs to maintain to be profitable. The break-even point is achieved when the generated profits match the total costs accumulated until the date of profit generation. In the linear case the break-even point is equal to the fixed costs divided by the contribution margin per unit. It is shown graphically as the point where the total revenue and total cost curves meet. In other words, it is the point at which the total revenue of a business exceeds its total costs, and the business begins to create wealth instead of consuming it. A profit or loss has not been made, although opportunity costs have been "paid" and capital has received the risk-adjusted, expected return. In economics and business, specifically cost accounting, the break-even point ( BEP) is the point at which cost or expenses and revenue are equal: there is no net loss or gain, and one has "broken even".

A simplified cash flow model shows the payback period as the time from the project completion to the breakeven.

0 kommentar(er)

0 kommentar(er)